Masters in Blockchain

I finished my masters in blockchain from Zigurat Innovation & Technology Business School from Barcelona Spain in 2021. It was an wonderful experience learning about blockchain and its capabilities and how it is driving change in the various business.

The Search for Specialization

After that I wanted to specialize in a domain where blockchain has a profound impact. I explored Gaming world that uses Metaverse along with emerging technologies like Blockchain, AR/VR, Cloud etc. I also explored traditional finance where blockchain was making inroads to banks and other financial institutions. Luckily Frankfurt School of Finance and Management in Germany has the The Frankfurt School Blockchain Center which conducts a completely free DeFi mentorship program for 18 weeks and the cohort is very diverse both in terms of geography, demography and industries. I applied for it and got selected. The program started on April 11th. More details about this program is available here.

Why DeFi?

Decentralized Finance is really the liberation of finance from cartel capitalism. It is very powerful in the human history like the impact internet had on people’s lives and companies and governments. Internet broke down lot of barriers that were erected in real-world that prevented a human’s voice from being heard where and when it mattered the most. Internet broke down the social order and empowered individuals to learn what they are interested in. Having worked in Investment Banking, Stock Market and Rating Agency and suffered heavily due to the 2009 Great Recession at the high-handedness of the governments and unruly market players in the finance sector, I decided to embark on a journey of alternative finance which has the potential for the masses and the potential for becoming mainstream as well. DeFi is the answer that I was seeking to my question of which trend will empower people to have more control over their financial future.

The Economic Cycle

Before even defining the assets, services, products and regulations for DeFi, it is important to understand how money flows in real-economy.

I read this wonderful book “The Future of Money: How the Digital Revolution Is Transforming Currencies and Finance” by professor Eswar S Prasad. This covers how economy works and it covers extensively the current financial system and the future which will be dominated by Central Bank Digital Currency along with other crypto coins. I simplifed the flow of money into these four stages as shown in the diagram in the left.

First there must be a financial instrutment to save money which helps assure enough liqudity. The second stage is to try to convert the idle savings into thriving investments which offer more interest than savings account. In the aftermath of 2009 financial crisis some governments has -ve interest rates for savings account and forced people to invest money in the market. The third stage is to take these investments as working capital loan or other useful loans. This capital is used to create more wealth, income and savings.

Finding this parallel in DeFi

The question for which I am exploring the answer in this DeFi program is to find a parallel to this cycle of capital flow in the DeFi world. If you see a parallel in the DeFi world write a post and share it with the world. If there is something much better than this cycle then write about it as well.

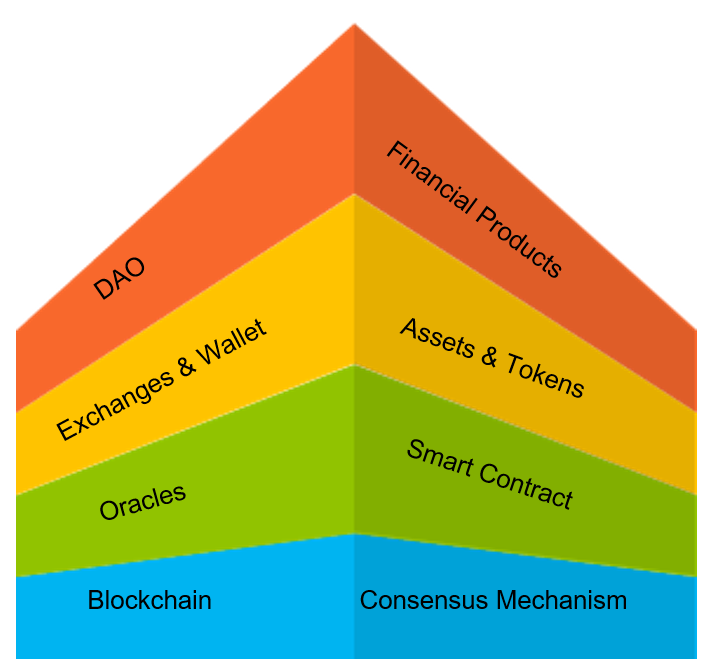

DeFi Techno Function Stack

The first assignment in my DeFi program had a question on how to visualize the DeFi Stack. I wanted to visualize it in two ways. The programmer in me obviously made me develop this Techno Function stack.

Before I build any DeFi application I want to choose the right blockchain platform. The pre-requisite I feel is that it should be a blockchain based platform because it solves some of the problems like double-spending, immutability etc and don’t need to reinvent the wheel. The next is the consensus mechanism that is used in blockchain to decide on the update to the ledger. Some consensus mechanisms like Proof-of-Work makes it expensive to update a ledger due to the amount of energy needed for validating the transactions and building the blocks. Hence consensus mechanism would be a driving criteria for me to decide on the platform for my DeFi applications.

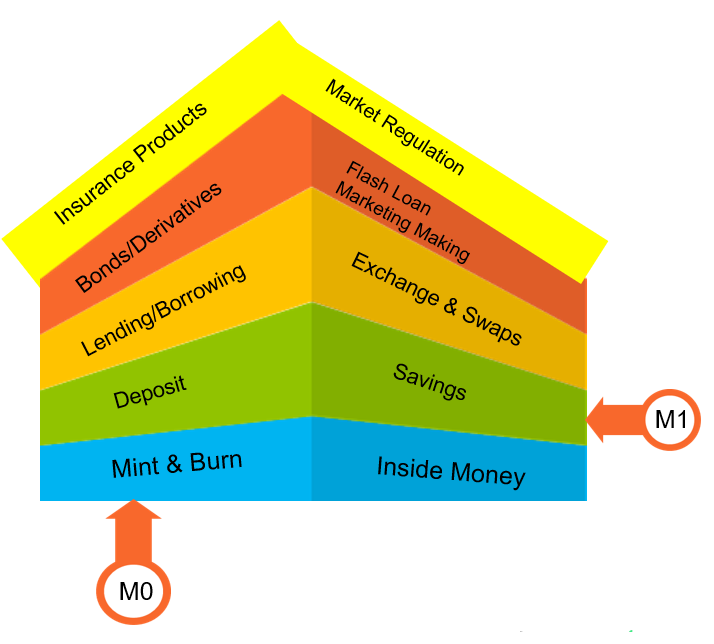

DeFi Economic Stack

Based on understanding of how central banks work especially US Federal Reserve, I came up with this diagram. I felt the bottom layers must be the equivalent of M0 and M1 from the traditional money.

M0 – the money that central bank can print and inside money refers to the money created by banks when the loan money to companies and individuals based on the savings in their account. Usually the loan amount offered in total is greater than the current savings in the banks. I need to learn more about leverage ratio to understand how inside money is created.

M1 – the money that is in the deposit or savings accounts that guarantees liquidity. The other two layers above them are pretty self-explanatory and I put the insurance products and market regulation as a cap to the stack. One of the products I learnt in my investment banking experience in Credit Default Swaps and I see that there is need for such products in the market in the future.

The current DeFi environment is ripe with scams and Ponzi schemes that is scaring people from investing in the new digital money. This has to be solved via regulation.

Stable Coins

Stable coins and Central Bank Digital Currency are the two topics I am interested in learning in the DeFi. In this module of this program I was asked to write about the stable coin that I am mostly likely to invest in.

The short answer to my stable coin of choice is Gemini Dollar from US. The people behind this stable coin are the famous Winklevoss Twins. To me the represent the anti-establishment against big tech companies. If you can read the book

Bitcoin Billionaires: A True Story of Genius, Betrayal and Redemption to know more about how the cartel in silicon valley did not allow them to invest in silicon valley. The main reason why I trust Gemini Dollar is that it is not just based by US dollar but also has additional safety as quoted below from their site.

Each GUSD corresponds to a U.S. dollar held by Gemini in accounts at U.S. FDIC-insured bank accounts and money market funds holding short-term U.S. treasury bonds and maintained at a custodian. The cash portion of these GUSD reserves may be eligible for FDIC “pass through” insurance for Gemini customers, in the event of the failure of a bank holding the U.S. dollar deposit portion of the GUSD reserves.

By backing the GUSD by funds in FDIC insured bank accounts it right away builds a credibility with mass consumers. All consumer savings and checking accounts are backed by FDIC and hence this makes the consumers believe that GUSD is also safe.

Since Gemini Dollar is backed by US dollar which is both the mostly used reserve currency as well as trade currency I find it attractive to invest in that. I also see their financial products like their own exchange, wallet, credit card and others to be a unique one in the market. I believe this ecosystem will grow.

Top 5 stable coins by market cap

The assignment had a question to list the stable coins by market cap. I went through this link and listed the top 5 stable coins by the market cap.

- Tether – USDT

- USD Coin – USDC

- Terra USD – UST

- Binance USD – BUSD

- Dai – DAI

Stable coin types

The question that was in the assignment was to list how stable coins achieve their stability and what risks are associated with the mechanism they use to achieve stability.

- Fiat Collateralized coins are backed by offchain assets and reserves in fiat currency. Eg: USDT, Gemini Dollar. The problem with this type of coins is that they always run into the risk of high-handedness of the government or the owner of the stablecoin network. In some cases participation might be denied. Another draw back is that most stable coins in this category are backed by USD dollar or Euro but there needs to be a basket of currencies similar to IMF’s SDR that way even if one country’s currency value is eroded. Crytocoins are for global market and hence need to cater to global customers.

- Cryptocollateralized coins are backed by over-collateralization of other crypto coins. Eg: DAI backed by ETH and other coins. The risks that I see in this type of stabilizing mechanism is that it depends on the minting of new coins in the other network. They are at the mercy of other coins. The other risk is that since over-collateralization is used that means the asset pledged is held below its market value and that creates shortage of funds.

- Non-collateralized coins are not backed by anything. They have same problems as fiat currency. The value of these coins are manipulated by the algorithmic minting and burning. Eg: Basis. I need to read some case studies on this topic to understand it better.

Why are APYs on stablecoins so high on lending platforms?

I don’t have much of an understanding about yielding and how it creates gains so this is what I inferred in my initial reading. The demand for the stablecoins continuously exceeds the supply. Stablecoins are the intermediary in buying and selling cryptocurrencies. USDT and USDC are the preferred coins through which other cryptocurrencies are bought on exchange.

They make great liquidity for exchanges and liquidity is needed to allay stakeholders fears about the system. If the bank has liquidity problem then its customers will be very nervous and it creates panic. We saw this first hand in 2016 in India due to demonitization.

The other reason I assume is that the price of stablecoins are stable and not volatile like other crypto coins and hence they are preferred as collateral in the DeFi world and this is also the reason for high APY on the stablecoins on lending platforms.

One additional question that was asked about stable coins was the following.

Does a stablecoin pegged to the official currency of your country exist yet?

The answer is no. India does not have stablecoins pegged to India Rupee. I read that RBI or the government has regulation that has made it illegal to use Rupee for a stablecoin.

Non-Fungible Tokens

- What is the significance of NFTs?

I am familiar with NFT tokens on Ethereum and not on other platforms. The most common type of token in Ethereum is ERC-20 token where each of them have same value. ERC-1155 and ERC-721 are non-fungible tokens whose values can be set by the user and create unique set of coins. These tokens have a serial number like feature which is like the one in real-world currency. The programming interface even has a method to get the owner of the coin if we pass the coin id and this option is not available for ERC-20.

You cannot swap one NFT token for another like swapping a 20$ currency for another 20$ currency. This is a very important feature to uniquely identify real-world and virtual assets on the blockchain and hence forms a basic building block for metaverse.

- Use-cases beyond art?

I suggested the following uses cases for NFT beyond art.

- Lottery – Each lottery ticket created can be either based on ERC-721 or ERC-1155.

- Education – Virtual Reality based chemistry experiments can be sold/rented as NFTs in Metaverse.

- Automotive – Each VIN number can be minted as NFT and used to create digital twin.

Decentralized Autonomous Organization (DAO)

This turned out to be a very interesting topic for me to learn. I am looking forward to learn more on this. My first thought when I heard this word in blockchain world was how will we build such organizations without the help of Artificial Intelligence. I delved deeper into this topic to find that smart contracts are the foundation for the DAOs and huge amount of transactions in blockchain world are running autonomously in the blockchain world. I explored about the Digix DAO and saw that it was not operational due to some regulatory issues with Singapore government. I am waiting to learn more about that because it uses Gold in the trading. I explored Maker DAO and some of its applications as part of this first assignment.

Connections

The first assignment was a thrill to work on and the research material provided by the school was very useful and in addition I read the following books as well. If you want to prepare for this DeFi program then follow the people listed below who run this program.

Prof. Dr. Philipp Sandner

Head of Frankfurt School

Blockchain Center

Jong-Chan Chung

Program Manager, Frankfurt

School Blockchain Center

Cedric Heidt

Deputy Program Manager,

Frankfurt School Blockchain

Center

Jan Carlos Janke

Partnerships Manager,

Frankfurt School Blockchain

Center

Masud Sultan

Core Team, Frankfurt School

Blockchain Center

Justus Schleicher

Frankfurt School Blockchain

Center

Sarah Palurovic

Frankfurt School Blockchain

Center

Robert Richter

Frankfurt School Blockchain

Center

Daniel Holk

Frankfurt School Blockchain

Center

Kiana Weiss

Frankfurt School Blockchain

Center

Reference Books

I read the following books in addition to the research materials provided by Frankfurt School Blockchain Center.

- The future of money

- Bitcoin Billionaires

- DAO – Decentralized Autonomous Organizations for Beginners: The Ultimate Beginner’s Guide /

- DeFi and the Future of Finance

- Eco-Autonomous Organizations: Decentralized, Distributed and Autonomous Organizations; An Operational Viewpoint of Complex Adaptive Systems